Clark Wealth Partners - Questions

Table of ContentsUnknown Facts About Clark Wealth PartnersNot known Facts About Clark Wealth PartnersThe Clark Wealth Partners PDFsWhat Does Clark Wealth Partners Do?Things about Clark Wealth PartnersGetting My Clark Wealth Partners To WorkThe Basic Principles Of Clark Wealth Partners

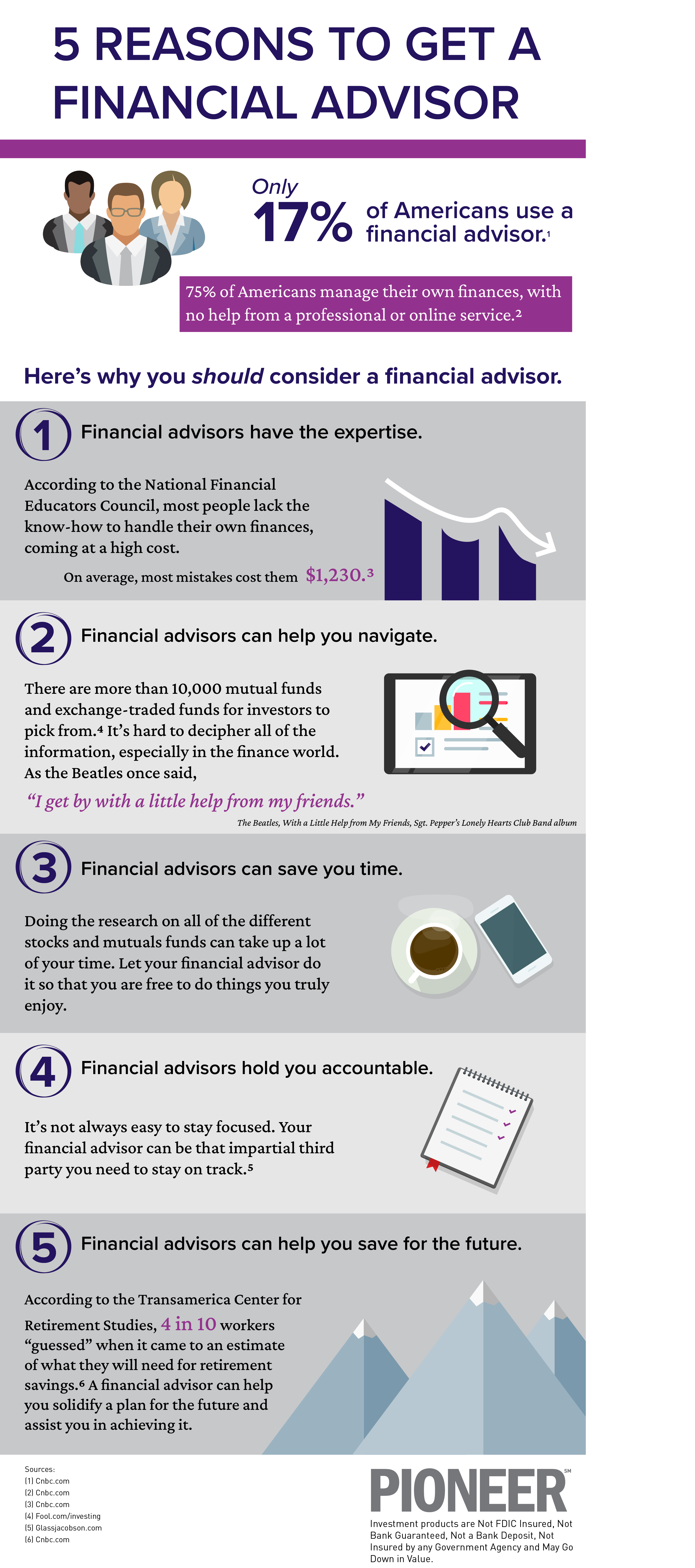

These are professionals who give financial investment advice and are signed up with the SEC or their state's securities regulator. Financial consultants can additionally specialize, such as in pupil financings, senior needs, tax obligations, insurance coverage and various other aspects of your funds.Not constantly. Fiduciaries are lawfully called for to act in their customer's finest rate of interests and to keep their cash and residential or commercial property separate from other assets they manage. Just monetary consultants whose classification requires a fiduciary dutylike qualified monetary coordinators, for instancecan say the very same. This difference likewise indicates that fiduciary and monetary advisor charge frameworks vary too.

Little Known Facts About Clark Wealth Partners.

If they are fee-only, they're extra most likely to be a fiduciary. Lots of qualifications and designations need a fiduciary responsibility.

Picking a fiduciary will certainly guarantee you aren't steered toward specific financial investments as a result of the compensation they offer - financial advisors Ofallon illinois. With great deals of cash on the line, you might want a financial expert that is legally bound to utilize those funds carefully and only in your benefits. Non-fiduciaries might recommend financial investment products that are best for their pocketbooks and not your investing objectives

The Definitive Guide to Clark Wealth Partners

Increase in cost savings the ordinary family saw that worked with a monetary consultant for 15 years or more contrasted to a comparable house without a financial advisor. "Much more on the Value of Financial Advisors," CIRANO Task Reports 2020rp-04, CIRANO.

Financial guidance can be useful at turning factors in your life. Like when you're beginning a family members, being retrenched, preparing for retirement or managing an inheritance. When you satisfy with a consultant for the initial time, exercise what you want to get from the advice. Before they make any recommendations, an adviser should make the effort to review what's vital to you.

Excitement About Clark Wealth Partners

When you've consented to go on, your monetary adviser will prepare a financial prepare for you. This is provided to you at another meeting in a file called a Declaration of Advice (SOA). Ask the advisor to explain anything you don't understand. You should constantly really feel comfortable with your consultant and their guidance.

Insist that you are informed of all transactions, which you receive all communication pertaining to the account. Your adviser might suggest a managed discretionary account (MDA) as a way of handling your investments. This involves authorizing an arrangement (MDA contract) so they can acquire or market investments without needing to get in touch with you.

Not known Facts About Clark Wealth Partners

Before you invest in an MDA, contrast the benefits to the costs and risks. To shield your money: Don't provide your advisor power of attorney. Never ever authorize a blank document. Place a time limitation on any authority you offer to deal investments in your place. Insist all communication concerning your financial investments are sent over here to you, not just your adviser.

This might occur during the conference or online. When you go into or renew the continuous charge arrangement with your adviser, they should explain just how to end your connection with them. If you're transferring to a new consultant, you'll need to organize to move your economic documents to them. If you require aid, ask your adviser to discuss the procedure.

To load their footwear, the nation will certainly need more than 100,000 brand-new economic advisors to get in the sector.

The Buzz on Clark Wealth Partners

Helping people accomplish their monetary objectives is a financial expert's primary function. But they are likewise a tiny organization proprietor, and a portion of their time is devoted to handling their branch office. As the leader of their method, Edward Jones financial consultants need the leadership skills to employ and handle staff, as well as the business acumen to develop and perform a service technique.

Financial consultants invest some time everyday enjoying or reading market information on television, online, or in profession magazines. Financial advisors with Edward Jones have the benefit of home workplace research teams that help them stay up to day on stock recommendations, shared fund management, and more. Investing is not a "collection it and forget it" task.

Financial experts need to schedule time each week to meet brand-new people and capture up with the individuals in their ball. Edward Jones economic consultants are lucky the home office does the heavy training for them.

The Definitive Guide for Clark Wealth Partners

Edward Jones financial advisors are urged to pursue extra training to broaden their understanding and abilities. It's also an excellent concept for monetary advisors to participate in market seminars.